Property Tax Information

Visit https://Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

Property taxes for the Austin Independent School District are collected by Travis County. Property owners will receive one consolidated bill from Travis County. Tax payments are not accepted at the Austin ISD Administration Building, but should be either mailed or taken to one of the Travis County offices. The mailing address for Travis County Tax Office is:

Celie Israel

Travis County Tax Office

P.O. Box 1748

Austin, TX 78767

Tax payment questions should be addressed to the Travis County Tax Office at (512) 854-9473. Physical locations can be found at the Travis County Tax Office website.

Tax Rate Documents

2025 Tax Rate and Budget Information (Property Tax Code 26.18)

Austin ISD Tax Rates

Austin ISD Board of Trustees will hold a public hearing on September 25, 2025, to discuss and adopt the current year tax rate.

There are two tax rates set for school districts in Texas. Maintenance and Operation is the rate applied to the tax base to support the general fund budget. Interest and Sinking is the rate applied to the tax base to cover debt service for the bonds approved by taxpayers. The M&O tax rate is subject to recapture, but the I&S tax rate is not. For information about how property taxes are collected in Travis County, visit the Travis Central Appraisal District website.

Important Note: Though Austin ISD sets the tax rate as a taxing entity, Austin ISD does not set property values. Property values are determined by the County Appraisal District.

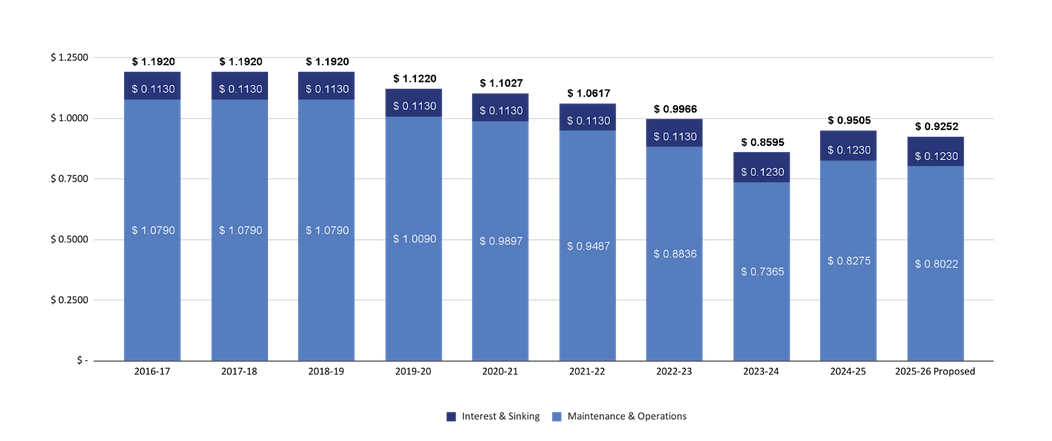

Property Tax Rate Per $100 of Taxable Value

The proposed total tax rate is a decrease of $0.0253 when comparing FY 2024-25 to FY 2025-26. The proposed 2026 fiscal year Interest & Sinking portion is $0.1230 per $100 of taxable value, and $0.8022 per $100 of taxable value for Maintenance & Operations.

| Tax Rates | FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | FY2026 Proposed |

|---|---|---|---|---|---|---|---|---|---|---|

| Interest & Sinking | $0.1130 | $0.1130 | $0.1130 | $0.1130 | $0.1130 | $0.1130 | $0.1130 | $0.1230 | $0.1230 | $0.1230 |

| Maintenance & Operations | $1.0790 | $1.0790 | $1.0790 | $1.0090 | $0.9897 | $0.9487 | $0.8836 | $0.7365 | $0.8275 | $0.8022 |

| Total Tax Rate | $1.1920 | $1.1920 | $1.1920 | $1.1220 | $1.1027 | $1.0617 | $0.9966 | $0.8595 | $0.9505 | $0.9252 |

To see how the school tax portion of your annual property taxes pay for all the services provided by Austin ISD, visit the Tax Rate Calculator.

Average Value Home in Austin ISD

| FY 2024-25 | FY 2025-26 with $100K Homestead Exemption |

FY 2025-26 with $140K Homestead Exemption |

|

|---|---|---|---|

| Average Home Taxable Value | $558,418 | $517,514 | $517,514 |

| Homestead Exemption | $100,000 | $100,000 | $140,000 |

| AISD Tax Rate per $100 value | $0.9505 | $0.9252 | $0.9252 |

| Estimated Taxes to AISD | $4,357 | $3,863 | $3,493 |

| Change from prior year | ($494) | ($864) | |

| Change between Homestead Exemptions | ($370) |

Note: Senate Bills 4 and 23, passed during the 89th Legislative Session, propose changes to the homestead exemption and school funding formulas. These measures require voter approval and will appear on the November 2025 election ballot.

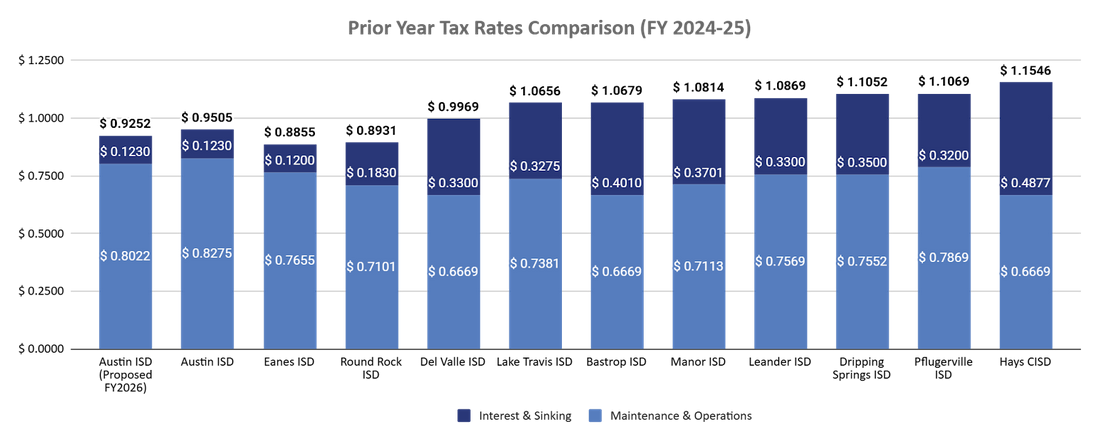

| Tax Rates | Austin ISD (Proposed FY2026) | Austin ISD | Eanes ISD | Round Rock ISD | Del Valle ISD | Bastrop ISD | Lake Travis ISD | Manor ISD | Dripping Springs ISD | Leander ISD | Pflugerville ISD | Hays CISD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Maintenance & Operations | $0.8022 | $0.8275 | $0.7655 | $0.7101 | $0.6669 | $0.6669 | $0.7381 | $0.7113 | $0.7552 | $0.7569 | $0.7869 | $0.6669 |

| Interest & Sinking | $0.1230 | $0.1230 | $0.1200 | $0.1830 | $0.3300 | $0.4010 | $0.3275 | $0.3701 | $0.3500 | $0.3300 | $0.3200 | $0.4877 |

| Total Tax Rate | $0.9252 | $0.9505 | $0.8855 | $0.8931 | $0.9969 | $1.0679 | $1.0656 | $1.0814 | $1.1052 | $1.0869 | $1.1069 | $1.1546 |

Debt

Austin ISD has earned the highest ratings for budget management from Moody’s Investors Service, Standard & Poor’s and Fitch Ratings. AISD also carries the highest bond and state financial accountability ratings that school districts can earn in the state of Texas. The links below provide information about AISD bonds and debt obligations.

- Texas Comptroller’s profile of AISD

- Texas Comptroller’s FY2021 debt report for AISD

- AISD Debt Transparency as of 06/30/21

- Texas Bond Review Board database

- Moody’s Rating report for AISD, Series 2022

- AISD investment policy

- AISD debt policy

- AISD commercial paper program

- AISD independent registered municipal advisor certificate

- AISD Unlimited Tax School Building and Refunding Bonds Series 2022 Official Statement

- KBRA Rating Report for AISD, Series 2023