Recapture

Passed by the 86th Texas Legislature in 2019, House Bill (HB) 3 made substantial changes to the Austin ISD's Chapter 49 (previously Chapter 41) recapture payment. House Bill 3 amended the Education Code to transfer certain sections from Chapter 41 to Chapter 49, and revised formulas used to determine excess local revenue under the FSP by adding Subchapter F, Chapter 48, Education Code, Section 48.257, Local Revenue in Excess of Entitlement. Texas Education Code, Chapter 49, provision recaptures local tax dollars from property-rich districts and redistributes the funds to property-poor districts; often referred to as “share the wealth” or “Robin Hood” plan.

Austin ISD is considered a property-rich school district. In FY2023-24, nearly 52.2 percent of all local revenue collected from property taxes is estimated to be subject to recapture; FY2024-25 budget includes an estimate that 52.4 percent of all local tax revenue will be subjected to recapture. In FY2023-24, Austin ISD anticipates the district will submit $699 million to the state in recapture funds. From FY2000-01 to FY2024-25, Austin ISD will have paid the state of Texas approximately $8.3 billion.

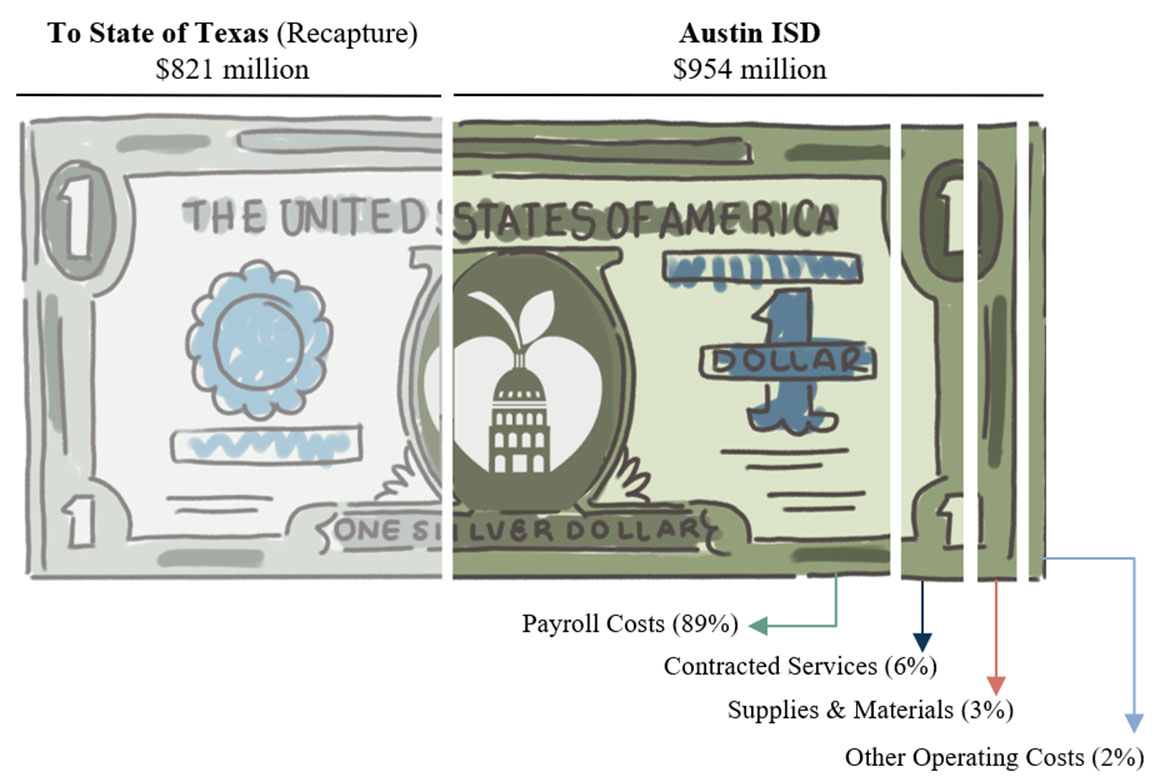

Figure 1: In FY2024-25 Adopted Budget, Austin ISD’s estimated recapture payment is $821 million, with a conservative assumption that enrollment will remain flat against the October 2023 PEIMS Student Snapshot. The payment will be almost half, 46.3 percent, of the District’s Adopted Expenditure budget of $1.78 billion.

The FY2024-25 Adopted General Fund expenditure budget estimates that 46.3 percent will comprise the district’s (Chapter 49) Recapture payment. When looking at the General Fund and excluding recapture, Salary Related expenses are at 89 percent of the fund. Professional and Contracted Services are at 6 percent; Supplies and Materials make up 3 percent; and Other Operating Costs come in at 2 percent of the General Fund budget.

Figure 1: FY2024-25 General Fund Adopted Expenditures - Breakdown of Each Dollar

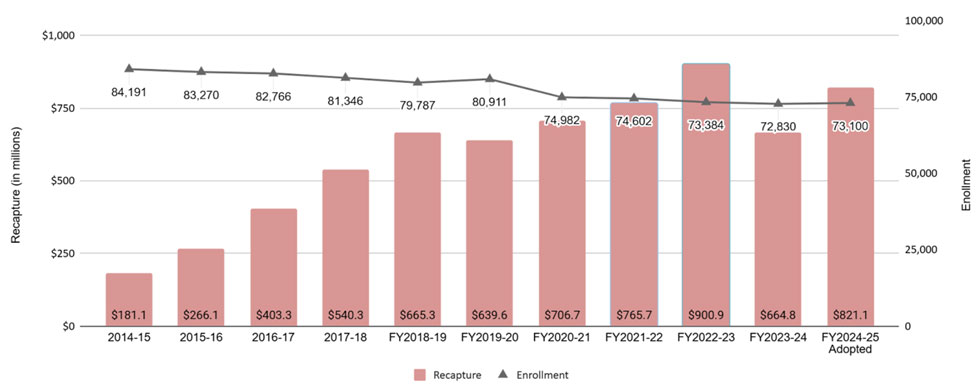

Figure 2: In FY2024-25, Austin ISD's estimated recapture payment is $821 million. This reflects a nearly a 400 percent increase in recapture when compared to payment made in FY2014-15.

Figure 2: Austin ISD's Recapture & Enrollment Comparison Over Years

| 20214-15 | 2015-2016 | 2016-2017 | FY2017-18 | FY2018-19 | FY2019-20 | FY2020-21 | FY2021-22 | FY2022-23 | FY2023-24 | FY2024-25 Adopted | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Recapture | $181,118,956 | $266,073,630 | $403,324,244 | $540,290,792 | $665,251,676 | $639,599,384 | $706,687,156 | $765,741,768 | $900,910,768 | $664,839,391 | $821,055,366 |

| Enrollment | 84,191 | 83,270 | 82,766 | 81,346 | 79,787 | 80,911 | 74,982 | 74,602 | 73,384 | 72,830 | 73,100 |

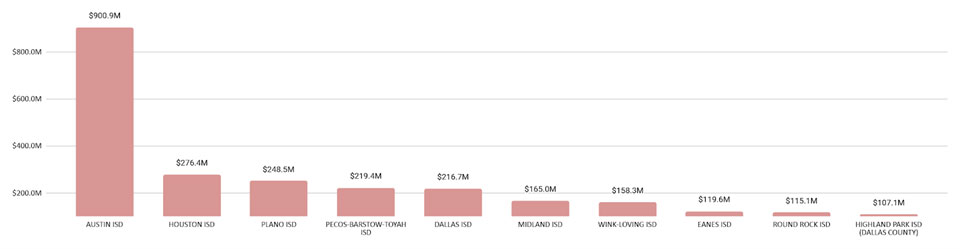

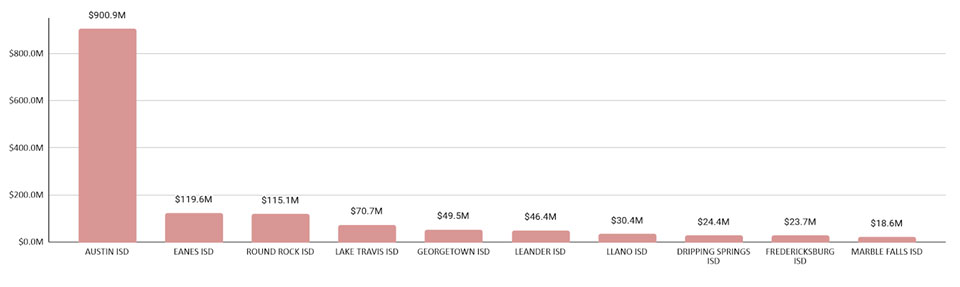

Figure 3: In FY2022-23, Austin ISD paid $624.5 million more in Recapture Payments than the second highest Texas School District. Austin ISD continues to be the largest payer into the state finance system.

Description of graphic above

Description of graphic above

Figure 4: In FY2022-23, Austin ISD paid $323.2 million more in recapture than the top 10 recapture paying Region 13 Districts combined.

Description of graphic above

Description of graphic above